iowa transfer tax calculator

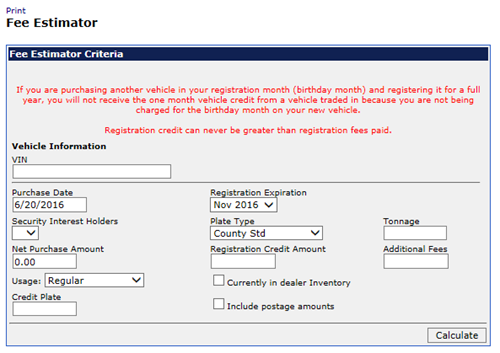

Type your numeric value in either the Total Amount Paid or Amount Due boxes. You can also find the total amount paid by entering the revenue tax stamp paid.

The Ultimate Guide To Iowa Real Estate Taxes Clever Real Estate

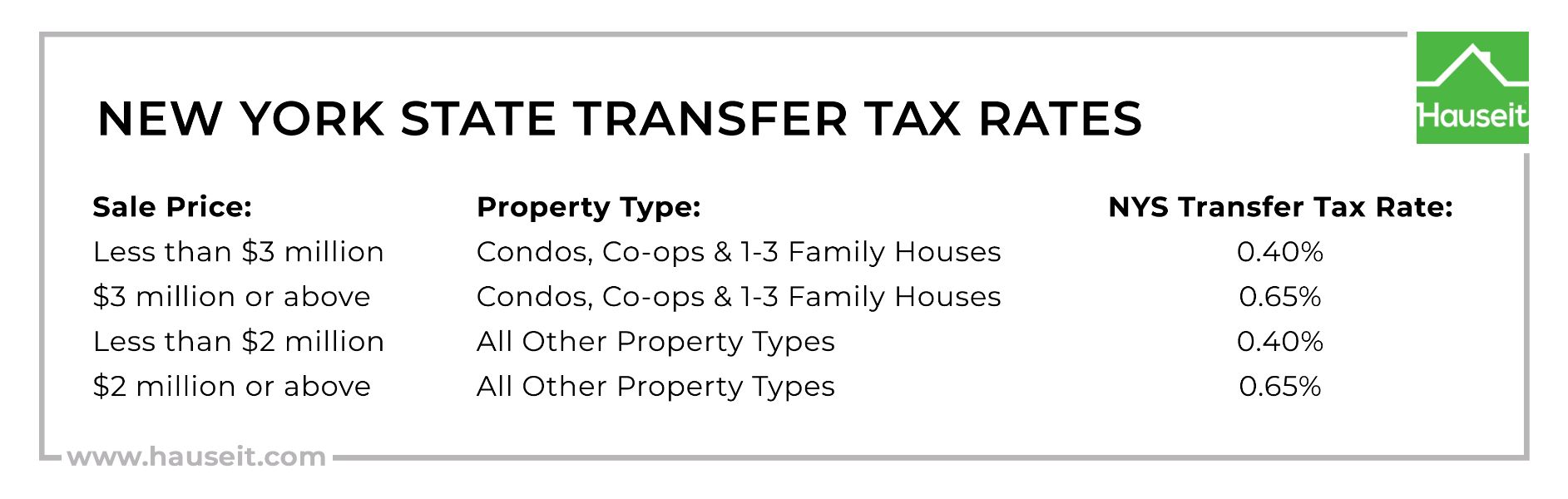

Current Tax Rate.

. This Calculation is based on 160 per thousand and the. Calculate the real estate transfer tax by entering the total amount paid for the property. Do not type commas or dollar.

You can also find the total amount paid by entering the revenue tax stamp. Adams County Iowa 500 Ninth. Calculate the real estate transfer tax by entering the total amount paid for the property.

Hours Holidays Department Hours. Returns either Total Amount Paid or Amount Due. You may calculate real estate transfer tax by entering the total amount paid for the property this calculation is based on 160 per thousand and the first.

The tax is paid to the county recorder in the county where the real property is located. Enter the amount paid in the top box the rest will autopopulate. Calculate the real estate transfer tax by entering the total amount paid for the property.

2000-2022 Electronic Services System All rights reserved. Returns either Total Amount Paid or Amount Due. You can also find the total amount paid by entering the revenue tax stamp.

Northwood IA 50459 Contact Us. Real Estate Transfer Tax Calculator. You can also find the total amount paid by entering the revenue tax stamp paid.

Type your numeric value in either the Total Amount Paid or Amount Due boxes. This calculation is based on 160 per thousand and the first 500 is exempt. Transfer Tax Calculator 1991 Present With this calculator you may calculate real estate transfer tax by entering the total amount paid for the property.

Real Estate Transfer Tax Calculator. You may calculate real estate transfer tax by entering the total amount paid for the property. Monroe County Iowa - Real Estate Transfer Tax Calculator.

Calculate the real estate transfer tax by entering the total amount paid for the property. This calculation is based on. You can also find the total amount paid by entering the revenue tax stamp.

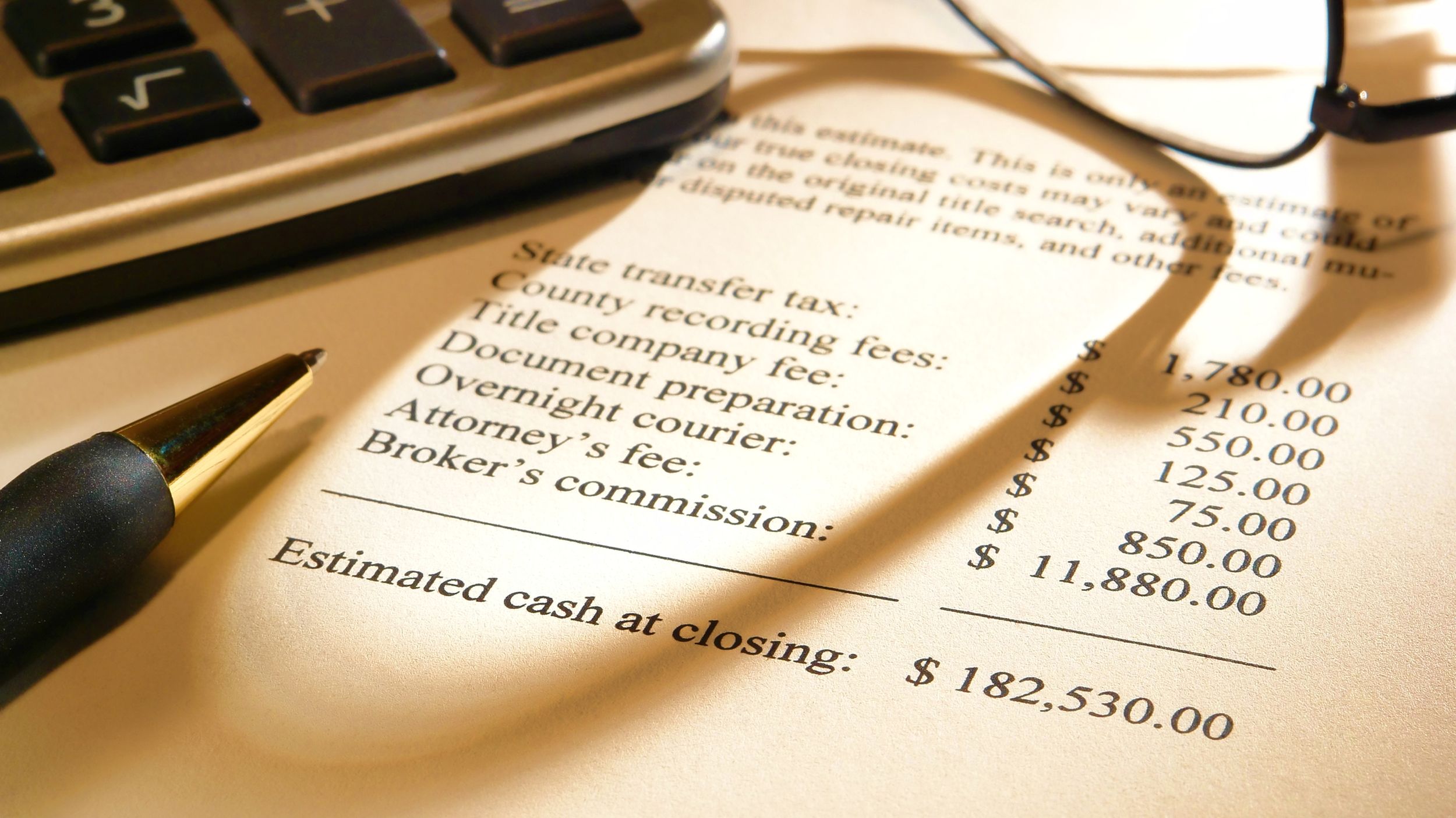

Returns either Total Amount Paid or Amount Due. The office collects real estate transfer tax for the Iowa Department of Revenue and collects and reports the County Auditors fee on transfer of property. 1932-1939 50 per 500.

The calculation is based on 160 per thousand with the first 500 being exempt. Worth County Iowa 1000 Central Ave. 1940-1967 55 per 500 1st.

Calculate the real estate transfer tax by entering the total amount paid for the property. Real Estate Transfer Tax Calculator. You can also find the total amount paid by entering the revenue tax stamp.

Total Amount Paid Must be. The tax is imposed on the total amount paid for the property. Real Estate Transfer Tax Calculator.

You can also find the total amount paid by entering the revenue tax stamp. Calculate the real estate transfer tax by entering the total amount paid for the property.

Title Transfers Linn County Ia Official Website

How Much Does It Really Cost To Sell A House In Iowa

Inheritance Tax 2022 Casaplorer

Capital Gains Tax Calculator Estimate What You Ll Owe

Ilr Holiday Message Large Iowa Land Records

Real Estate Transfer Taxes Deeds Com

What Are Real Estate Closing Costs And How Much Will You Pay The Spokesman Review

Calculate Your Transfer Fee Credit Iowa Tax And Tags

New Jersey Sales Tax Calculator And Local Rates 2021 Wise

Capital Gains Tax Calculator 1031 Crowdfunding

Hunter Education Course News Story

Search And Submit Land Records Statewide Iowa Land Records

Changes To Iowa Composite Returns For Tax Year 2022 Onward Forvis

Monroe County Iowa Transfer Tax Calculator

Motor Vehicle Scott County Iowa

Auto Loan Calculator With Tax Tag Fees By State