uber eats tax calculator canada

Uber Eats Pay Rate. Type of supply learn about what.

Tax Deductions For Rideshare Uber And Lyft Drivers And Food Couriers Get It Back

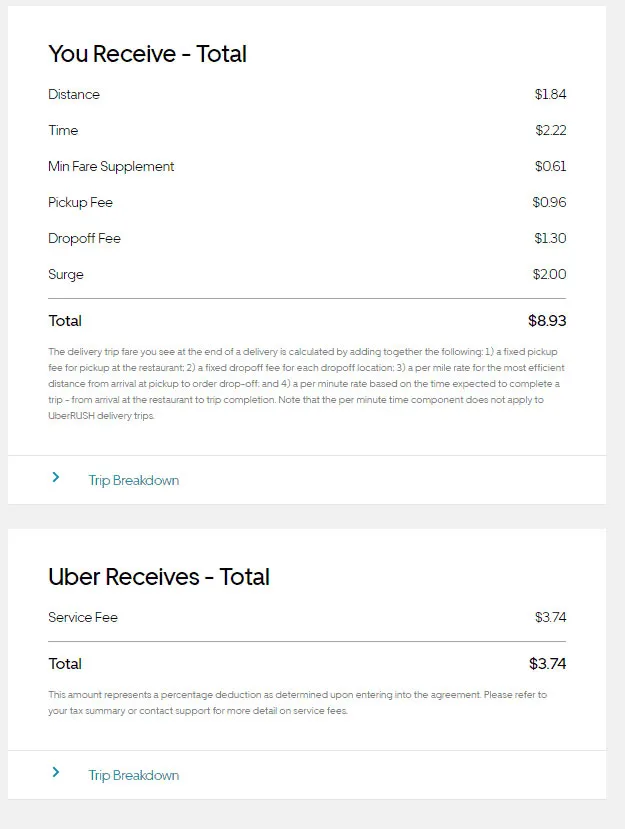

Uber rdies service fee 1811873.

. As such Uber drivers must keep records of the money they receive. Uber Eats Tax Calculator How Much Extra Will I Pay From Uber Eats Income Here are the rates. The Canada Revenue Agency CRA requires that you file income tax each year.

In accordance with the rules and regulations outlined by the Canada Revenue Agency CRA Uber drivers Uber Eats Lyft. Well send you a 1099-K if. In other words it reduces your taxable Uber income.

Using our Uber driver tax calculator is easy. Your federal tax rate may range from 10 to 37 and your state tax rate can range from 0 to. People aged 19 years old and over in Toronto can order.

The rate you will charge depends on different factors see. You earned more than. Sales tax breakdown.

If you put 10000 miles on your car thats a 5600 expense deduction you can claim on your taxes for the 2021 tax year. I had shown various ways to claim your expenses and reduce your taxes. Your average earnings per ride.

The following table provides the GST and HST provincial rates since July 1 2010. Same pizza same toppings. Here are the rates.

Now out of these total information I want to know 1- that my. The rate is 72 cents per km so your. In accordance with the rules and regulations outlined by the Canada Revenue Agency CRA Uber drivers Uber Eats Lyft.

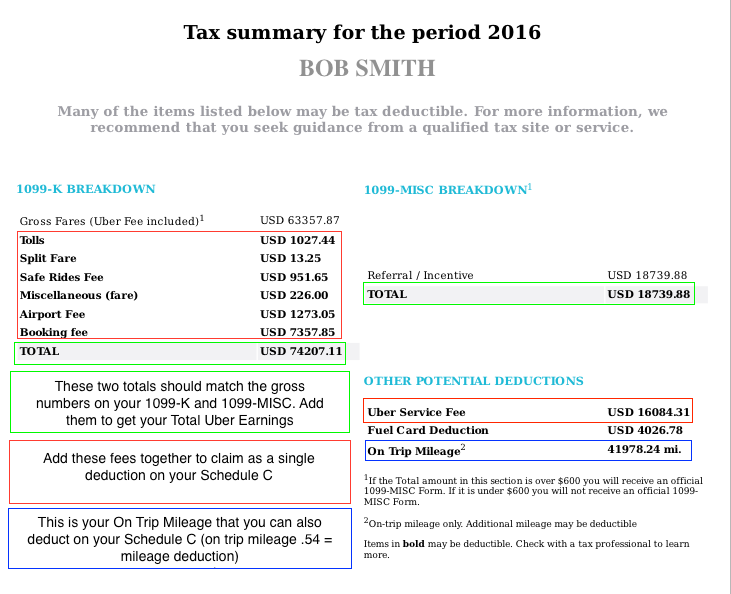

Your 1099-K is an official IRS tax document that includes a breakdown of your annual on-trip gross earnings. The first one is income taxes both on federal and state levels. According to my Uber Tax Summary I earned 26300 driving with Uber Eats in 2019.

Agencies Uber Eats partnered with Leafly and will deliver marijuana to peoples doorsteps starting Monday in Canada. This method allows you to claim a maximum of 5000km at a set rate so your total deduction is quite limited. When you drive with Uber income tax is not deducted from the earnings you made throughout the year.

If an Uber driver bills more than 30000 in a calendar year they they have to register for HST collect HST from Uber clients and remit the taxes to CRA. Understanding your 1099 forms Doordash Uber Eats Grubhub. Uber drivers are considered self-employed in Canada otherwise known as an independent contractor.

Introduction to Income Taxes for Ride-Sharing Drivers. HST on Uber rides 1163640. If you register for HST you are.

This is because VAT is. The Canada Revenue Agency CRA is responsible for collecting remitting and filing sales tax on all of your ridesharing trips. Drivers who earn money through uber and lyft as a sole proprietorship must.

The Road To Zero Emissions Drive Uber

Doordash Taxes Does Doordash Take Out Taxes How They Work

How To Use Crypto Com Tax Software Free Crypto Tax 2021 2022 Calculator Cheatsheet Fangwallet

Uber Subsidiaries 11 Companies Owned By Uber Technologies

Uber Tax Explained The Ultimate Guide To Tax For Uber Rideshare

Uber Eats Driver Pay Calculator For Canada And Usa

Top 7 Mistakes That Rideshare Drivers Make At Tax Time Stride Blog

Uber Eats 15 Gift Card Email Delivery Newegg Com

Free Uber Tax Accounting Software Instabooks Us

12 Best Crypto Tax Software In 2022

Uber Eats Uber Eats To Soon Deliver Marijuana Legally To People S Doorstep In Canada The Economic Times

Why Does My Uber Eats 1099 Or Annual Tax Summary Say I Made More Than I Did Entrecourier

Even If Uber Rides Come To A Stop In California Uber Eats Still Has A Green Light Marketwatch

How Income Taxes Work In Canada With Example And Simple Online Tax Calculator Youtube

Amex Platinum Uber Credits How To Use For Rides And Uber Eats

The Road To Zero Emissions Drive Uber

Uber Eats Uber Eats To Soon Deliver Marijuana Legally To People S Doorstep In Canada The Economic Times